Nexus Market FAQ Questions Answered

Common questions about Nexus Market answered. Learn what Nexus was, how it worked, and what happened to the platform.

General

Nexus General Questions

Basic information about Nexus Market and its status.

Nexus Market was a darknet marketplace that operated from November 2023 to January 2025. The platform distinguished itself through a modern cyberpunk-inspired interface and multi-currency payment support. It served over 50,000 users before shutting down in an exit scam.

The platform accepted Bitcoin, Monero, and Litecoin payments. Escrow protection was mandatory for all transactions. The marketplace supported international vendors and buyers globally.

Nexus featured built-in forums for community discussion. The platform claimed DAO governance structures. Mobile optimization allowed smartphone access unlike many competitors.

No, Nexus Market is not operating. The platform shut down on January 18, 2025, when administrators conducted an exit scam. Any website claiming to be this market is fraudulent. Do not attempt to access or deposit funds to any such site.

Administrators conducted an exit scam in January 2025. The team shut down the platform and stole user funds. Approximately $15 million in cryptocurrency was taken during this event. The situation affected over 50,000 registered users.

Warning signs appeared days before shutdown. Users reported withdrawal delays and support ticket responses slowing. These indicators typically precede exit scams. Community forums posted warnings but many users ignored them.

The shutdown occurred without warning. All mirrors went offline simultaneously. The coordinated timing suggests careful planning by administrators.

Nexus Market operated for approximately fourteen months total duration. The platform launched in November 2023 and shut down in January 2025. During this operational period, it grew rapidly to become one of the larger darknet marketplaces before the exit scam.

Growth accelerated throughout 2024. By mid-2024 the platform reached top-2 market position globally. Transaction volume increased monthly consistently until the sudden shutdown.

The fourteen-month timeline matches patterns from other exit scams. Markets typically build trust systematically before stealing funds. Longer operation periods maximize potential theft amounts significantly. Building user base and strong reputation requires significant time investment before exit.

Vendors paid bonds ranging from $500 to $2,000. Product categories determined bond amounts. Higher-risk items required larger security deposits.

New vendors faced listing restrictions. Accounts under 30 days could list 10 products maximum. This prevented spam and scams from new sellers.

Commission rates started at 5% for Level 1 vendors. Established sellers achieved 3% rates through volume. The system rewarded consistent high-quality vendors.

Buyers could open disputes before auto-finalize deadlines. Moderators reviewed evidence from both parties. Resolution took 3-7 days typically.

Buyers won approximately 40% of disputes. Vendors prevailed in 45% of cases. The remaining 15% resulted in partial refunds or compromises.

Dispute outcomes affected vendor ratings permanently. Multiple lost disputes led to account review. Three disputes in 30 days triggered suspension procedures.

Default auto-finalize occurred after 14 days. Vendors could set custom periods between 7-21 days. Extensions required buyer approval explicitly.

The timer started after order confirmation. Buyers received notifications before finalization. Missing the deadline meant automatic payment release to vendors.

This system balanced buyer and vendor interests. Vendors received payment eventually. Buyers maintained control during the window.

Using VPN with Tor Browser is debated. Some argue VPNs add protection. Others claim VPNs reduce Tor anonymity benefits.

The Tor Project recommends Tor alone typically. VPNs introduce additional trust requirements. Your VPN provider sees your traffic before Tor.

Bridges provide better alternatives than VPNs. They hide Tor usage from ISPs. The Tor Browser includes bridge options.

The platform supported over fifteen languages. Interface translations covered major world languages. This expanded global marketplace reach significantly.

English served as the default language. Users switched languages from account settings. Product listings appeared in vendor-chosen languages.

Community forums supported multilingual discussions. This attracted international vendor and buyer communities. Language barriers decreased through translation features.

Payments

Nexus Payment Questions

Information about Nexus cryptocurrency and payment options.

Nexus Market accepted three cryptocurrencies: Bitcoin (BTC), Monero (XMR), and Litecoin (LTC). This multi-currency support exceeded many competitors. Users chose payment methods based on their privacy preferences and cryptocurrency holdings.

Bitcoin required 3 network confirmations before deposits appeared. Withdrawals processed within 24 hours typically. The platform charged small network fees for transactions.

Monero offered superior privacy with 10 required confirmations. Litecoin processed faster with 6 confirmation requirements. Exchange rates updated every 10 minutes automatically.

Yes, escrow was used for all transactions. The system held buyer funds until order confirmation. This protection prevented vendor-level fraud. However, escrow could not protect against the platform-level exit scam.

Auto-finalize defaulted to 14 days after order placement. Vendors could customize between 7-21 days. Buyers maintained control until finalization occurred.

Disputes could be opened before auto-finalize deadlines. Moderators reviewed evidence within 3-7 days. The escrow system worked well for individual transactions despite ultimate platform failure.

Unfortunately, funds lost in the exit scam cannot be recovered. Cryptocurrency transactions are irreversible by design. The administrators transferred stolen funds to anonymous wallets. There is no mechanism to reverse these cryptocurrency transactions.

Law enforcement investigations began after the shutdown. Blockchain analysis tracked stolen cryptocurrency movements. The funds moved through multiple mixers immediately.

This sophistication suggests premeditated planning. Recovery through legal channels remains extremely unlikely. Cryptocurrency anonymity prevents tracing beyond certain points.

Security

Nexus Security Questions

Questions about Nexus security features and practices.

Yes, PGP encryption was supported for communications. The platform published an official PGP key for link verification. Vendors also had PGP keys for encrypted messaging. Users encrypted sensitive information before sending.

The official PGP key fingerprint appeared on all verified pages. Users imported vendor keys before communicating. This prevented message interception by third parties.

PGP protected communications but not funds. The exit scam occurred at platform level. No encryption prevents administrator theft.

Learning PGP takes time but pays off for security. Multiple tutorials existed on darknet forums. The skill transfers to all secure communications beyond marketplaces.

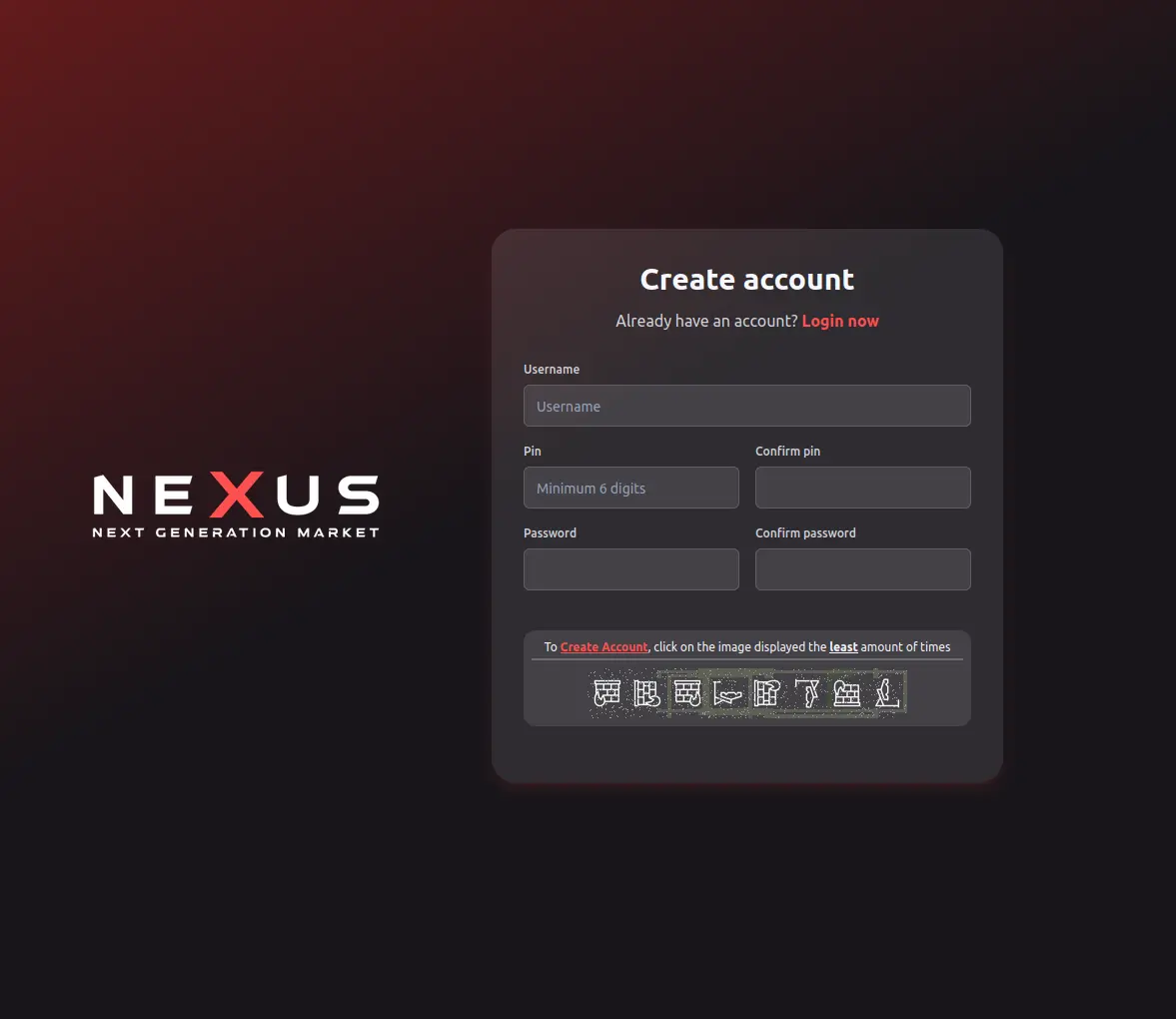

Yes, 2FA was required for all user accounts. The two-factor authentication used standard TOTP codes. Users needed authenticator apps to generate login codes. This security feature protected individual accounts from unauthorized access.

Setup occurred during registration process. Users scanned QR codes with apps like Google Authenticator. Backup codes provided account recovery options.

2FA prevented account hijacking effectively. The feature worked well during platform operation. However security features cannot prevent platform-level exit scams.

Security features protected user-to-user interactions, not platform-level theft. PGP, 2FA, and escrow prevented external attacks and vendor fraud. However, no feature could prevent administrators from accessing platform-controlled wallets. The exit scam exploited centralized control that security features cannot address.

Links were verified through PGP signature checking. The team published signed mirror lists. Users imported the public key and verified signatures on link lists. Only links with valid signatures were considered authentic. This process prevented phishing attacks.

Access

Nexus Access Questions

How Nexus Market access worked during operation.

Nexus was accessed through Tor Browser using onion links. Users downloaded Tor from torproject.org, verified Nexus mirror links, then accessed the platform. Regular browsers could not reach Nexus onion addresses.

Yes, the platform was mobile-optimized. The interface worked on smartphones through Tor Browser or Onion Browser apps. This mobile support was unusual for darknet markets. Many users appreciated the responsive design for mobile access.

No. Do not attempt to access any site claiming to be this market. The real platform is permanently offline. Any current branded site is a scam targeting former users. These fake sites steal login credentials and deposits. The actual platform no longer exists.

Lessons

Lessons from Nexus Market

What the Nexus situation teaches about darknet marketplace safety.

Main Points

The Nexus Market exit scam provides important lessons for darknet marketplace users. Understanding what happened helps protect against similar situations in the future.

- Minimize stored funds: Never keep more cryptocurrency on any market than needed for active transactions

- Withdraw quickly: Move funds to personal wallets immediately after transactions complete

- Watch warning signs: Withdrawal delays often indicate problems before shutdown

- Features mean nothing: Good security doesnt prevent exit scams - trust no platform fully

This case demonstrates that even popular, feature-rich marketplaces can disappear overnight with user funds. No amount of security features, modern design, or positive reputation prevents exit scams. The only protection is minimizing exposure.

Remember the Lesson

Every cryptocurrency stored on a darknet marketplace is at risk. Users who lost the most were those with large stored balances. Treat any marketplace, regardless of reputation, as potentially fraudulent. This story ensures you wont make the same mistake trusting platform custody.

More Nexus Information

Learn more about Nexus Market history and view historical mirror links.